Similar Questions

Explore conceptually related problems

Recommended Questions

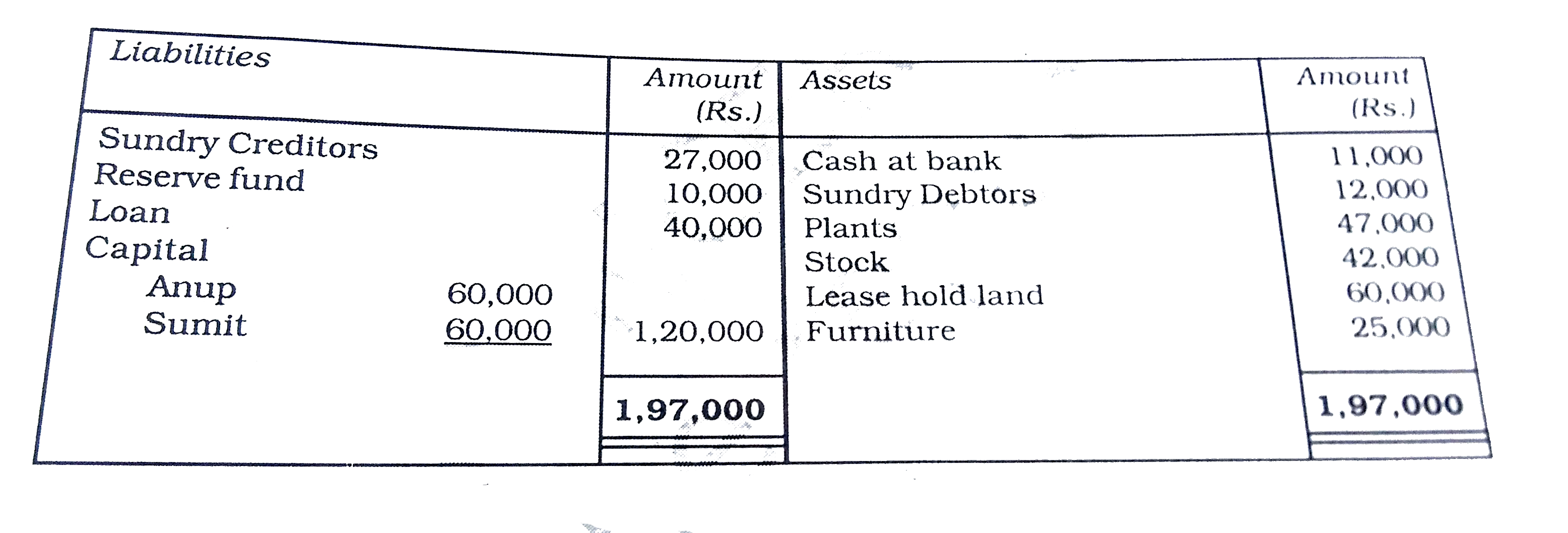

- Anup and Sumit are equal partners in a firm. They decided to dissolve ...

Text Solution

|

- निम्न का कारण स्पष्ट कीजिए - (क) जलोद्भिद में वायु अवकाश अत्यधिक ...

Text Solution

|

- 1.5 वोल्ट का एक आदर्श सेल 100 Omega तथा 200 Omega के प्रतिरोधों क...

Text Solution

|

- एक व्यक्ति ₹ 1000 का नोट लेकर बैंक जाता है। वह कैशियर से बदले में केवल...

Text Solution

|

- श्री मोहित ने एक निश्चित दूरी के लिए ट्रेडमिल पर चलने का फैसला किया है...

Text Solution

|

- एक रेखिक समीकरण दी गई है । दो चरो में एक ऐसी और रेखिक समीकरण लिख...

Text Solution

|

- समस्याओ में रेखिक समीकरणों के युग्म बनाइए और उनके हल (यदि उनका ...

Text Solution

|

- समस्याओ में रैखिक समीकरणो के युग्म बनाइए और अनके हल ( यदि उनक...

Text Solution

|

- LiCl की घनीय एकक कोष्ठिका (NaCl सदृश) की कोर का मान 5.14 Å है । ऋणायन-...

Text Solution

|