Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

CHETANA PUBLICATION-Financial Planning-EXERCISE

- If 500 shares of face value ₹100 were sold at ₹50 premium,then how muc...

Text Solution

|

- A sum of ₹75,000 invested in shares of face value ₹100 at ₹125 market ...

Text Solution

|

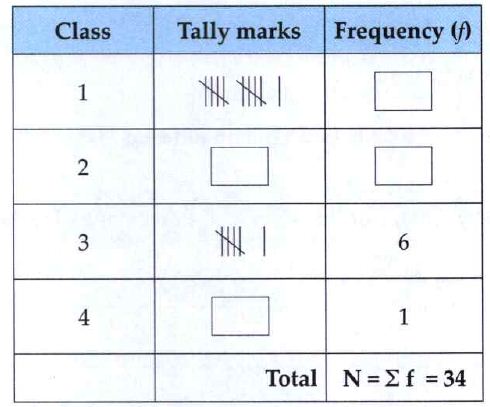

- Complete the following table.

Text Solution

|

- Mr. Deshmukh's investment in shares is given below. Find his total inv...

Text Solution

|

- A share was sold at ₹950 market value and brokerage of 0.2% was paid, ...

Text Solution

|

- Mr.Kumar invested ₹25,000 in a mutual fund scheme.The NAV of one unit ...

Text Solution

|

- Mrs. Sita invested ₹92,124 in shares of face value ₹10 each at ₹90 mar...

Text Solution

|

- Mr. Chavan purchased 100 shares of ₹100 face value at ₹150 market valu...

Text Solution

|

- Mr. Sawant invested ₹2,50,295 in shares of face value ₹100 each at ₹12...

Text Solution

|

- Rate of GST (%) on essential commodities is….a)0 b)5 c)12 d)28

Text Solution

|

- If NAV of one unit is ₹25, then how many units will be allotted for th...

Text Solution

|

- Pawan Medical supplies medicines. On some medicines, the rate of GST i...

Text Solution

|

- A person paid ₹75 brokerage for buying 100 shares. The rate of GST on ...

Text Solution

|

- Find the purchase price of a share of FV ₹100 if it is at premium of ₹...

Text Solution

|

- Smita has invested ₹12,000 and purchased shares of FV ₹10 at a premium...

Text Solution

|

- 50 shares of FV ₹10 were purchased for MV of ₹25. Company declared 30%...

Text Solution

|

- Prepare Business to Customer(B2C) tax invoice using given information....

Text Solution

|

- M/s Jay chemicals purchased a liquid soap having taxable value ₹8,000 ...

Text Solution

|

- Shri Aditya Sanghavi invested ₹50,118 in shares of FV of ₹100, when th...

Text Solution

|

- Smt. Agarwal invested ₹10,200 when MV of the share is ₹100. She sold 6...

Text Solution

|