Text Solution

Verified by Experts

The correct Answer is:

Topper's Solved these Questions

Similar Questions

Explore conceptually related problems

ICSE-GST [GOODS AND SERVICES TAX] -Exercise 1(A)

- For the following transaction within Delhi, fill in the blanks to find...

Text Solution

|

- For the following transaction from Delhi to jaipur, fill in the blan...

Text Solution

|

- A computer machanic in Delhi charges repairing cost from five differen...

Text Solution

|

- Find the amount of bill for the following intra-state transaction of g...

Text Solution

|

- Find the amount of bill for the following inter-state transaction of g...

Text Solution

|

- Find the amount of bill for the following intra-state transaction of g...

Text Solution

|

- For the date given above in question no. 6 find the amount of bill for...

Text Solution

|

- A dealer in Mumbai supplied some items at the following prices to a de...

Text Solution

|

- National Trading Company, Meerut (UP) made the supply of the following...

Text Solution

|

- M/s Ram Traders, Delhi provided the following services to M/s Geeta Tr...

Text Solution

|

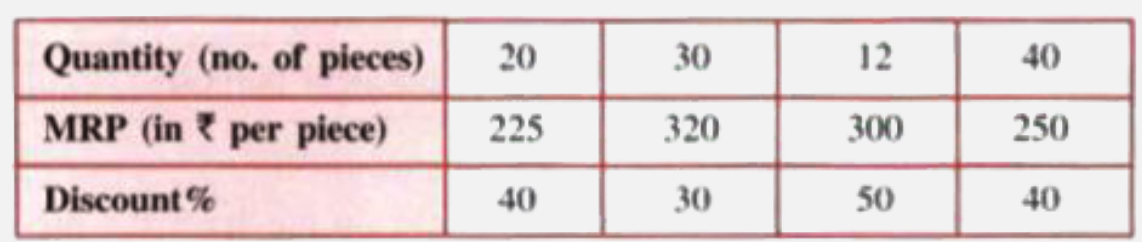

- For the following find the amount of bill data :

Text Solution

|

- The tax invoice of a telecom service in Meerut shows cost of services ...

Text Solution

|

- Mr. Pankaj took Health Insurance Policy for his family and paid Rs. 90...

Text Solution

|

- Mr. Malik went on a tour to Goa. He took a room in a hotel for two at ...

Text Solution

|

- Ashraf went to see a movie. He wanted to purchase a movie ticket for R...

Text Solution

|