Similar Questions

Explore conceptually related problems

Recommended Questions

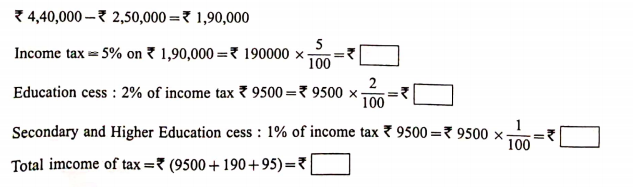

- Complete the following activities Smt Lilavati, who is 52 years old, ...

Text Solution

|

- Match the following lists:

Text Solution

|

- Which of the following are correct chain isomers of butane ? (i) <img ...

Text Solution

|

- Determine the point of symmetry of a regular hexagon. <img src="htt...

Text Solution

|

- Complete adjectant figure so that X-axis and Y-axis are the lines of s...

Text Solution

|

- Dtermine the images of the following figure about the given line : ...

Text Solution

|

- Match the following Column A to Column B

Text Solution

|

- Match the following Column A to Column B

Text Solution

|

- Match the following Column A to Column B

Text Solution

|