A

B

C

D

Text Solution

Verified by Experts

The correct Answer is:

Similar Questions

Explore conceptually related problems

Recommended Questions

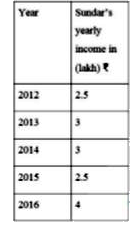

- Sundar earns by conducting coaching classes. 10% of his income goes in...

Text Solution

|

- The value of |[a,a+d,a+2d] , [a+d,a+2d,a+3d] , [a+2d,a+3d,a+4d]|+|[b,b...

Text Solution

|

- In the given figure, PQRS is a parallelogram. A and B are the mid-poin...

Text Solution

|

- The correct order of size among Br^(+), Br, Br^(-)

Text Solution

|

- 1) Fragmentation () a) Planaria br 2) Unripe fruits () b) Yeast br 3) ...

Text Solution

|

- వేర్ల ద్వారా శాఖీయోత్పత్తి జరిపే మొక్కbr i) డాలియాbr ii) ముల్లంగ...

Text Solution

|

- Find correct features w.r.t. most advanced type of placentation. Br a....

Text Solution

|

- Wite down the corresponding elements in the figure : 1)……………… br 2)………...

Text Solution

|

- Consider the following modified structures in plants and select ontoge...

Text Solution

|