Text Solution

Verified by Experts

Topper's Solved these Questions

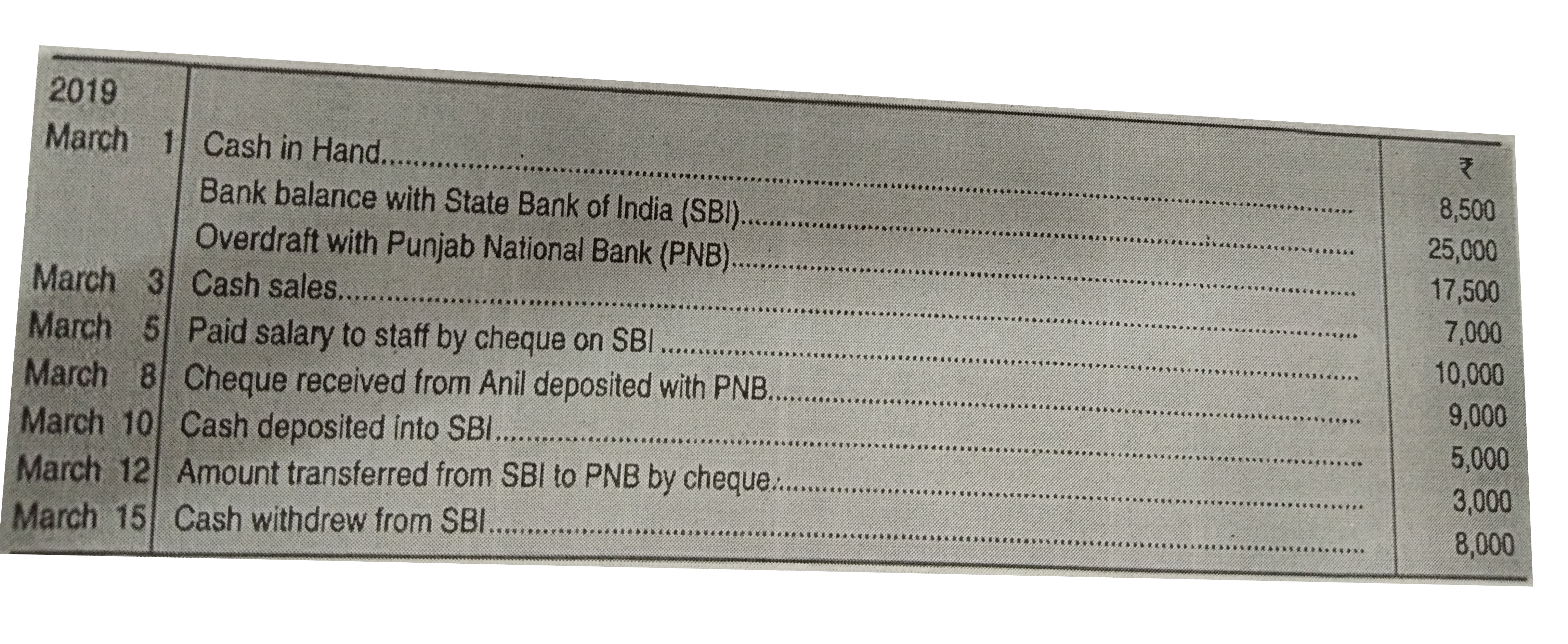

SPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise HIGHER ORDER THINKING SKILLS (HOTS) QUESTIONS|6 VideosSPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise MULTIPLE CHOICE QUESTIONS (MCQs)|13 VideosRECTIFICATION OF ERRORS

TS GREWAL|Exercise Practical Problems|48 VideosSPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Practical Problems|24 Videos

Similar Questions

Explore conceptually related problems