Topper's Solved these Questions

SPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES|2 VideosSPECIAL PURPOSE BOOKS I-CASH BOOK

TS GREWAL|Exercise SHORT ANSWER TYPE QUESTIONS|8 VideosRECTIFICATION OF ERRORS

TS GREWAL|Exercise Practical Problems|48 VideosSPECIAL PURPOSE BOOKS II - OTHER BOOKS

TS GREWAL|Exercise Practical Problems|24 Videos

Similar Questions

Explore conceptually related problems

TS GREWAL-SPECIAL PURPOSE BOOKS I-CASH BOOK -PRACTICAL PROBLEMS

- Enter the following transactions fo Ripinder, Delhi in a Single Column...

Text Solution

|

- Prepare Simple Cash Book from the following transactions of Suresh Del...

Text Solution

|

- Prepare Simple Cash Book of Gopal of Amritsar from the following trans...

Text Solution

|

- Prepare Simple Cash Book from the following Transactions of Simran, De...

Text Solution

|

- From the following prepare Single Column Cash Book of Suresh, Chennai ...

Text Solution

|

- Record the following teransactions of Sumanto, Kochi in a Two-column C...

Text Solution

|

- Enter the following transactions in the Double Column Cash Book of M/s...

Text Solution

|

- Prepare Two-column Cash Book of Bimal, Lucknow from the following tran...

Text Solution

|

- Prepare Two-column Cash Book from the following trasnactions of Mani, ...

Text Solution

|

- Prepare Two-column Cash Book of Vinod, Delhi from the following transa...

Text Solution

|

- Enter the following transactions in the Cash Book of Chandrika Co. Cha...

Text Solution

|

- Enter the following transactions in Two-column Cash Book of Reems, Cha...

Text Solution

|

- Write the following transactions in the Cash Book of Premium Stores, K...

Text Solution

|

- Enter the following transactions in Two-column Cash Book of Gaurav, De...

Text Solution

|

- From the following information, prepare an Analytical Petty Cash Book,

Text Solution

|

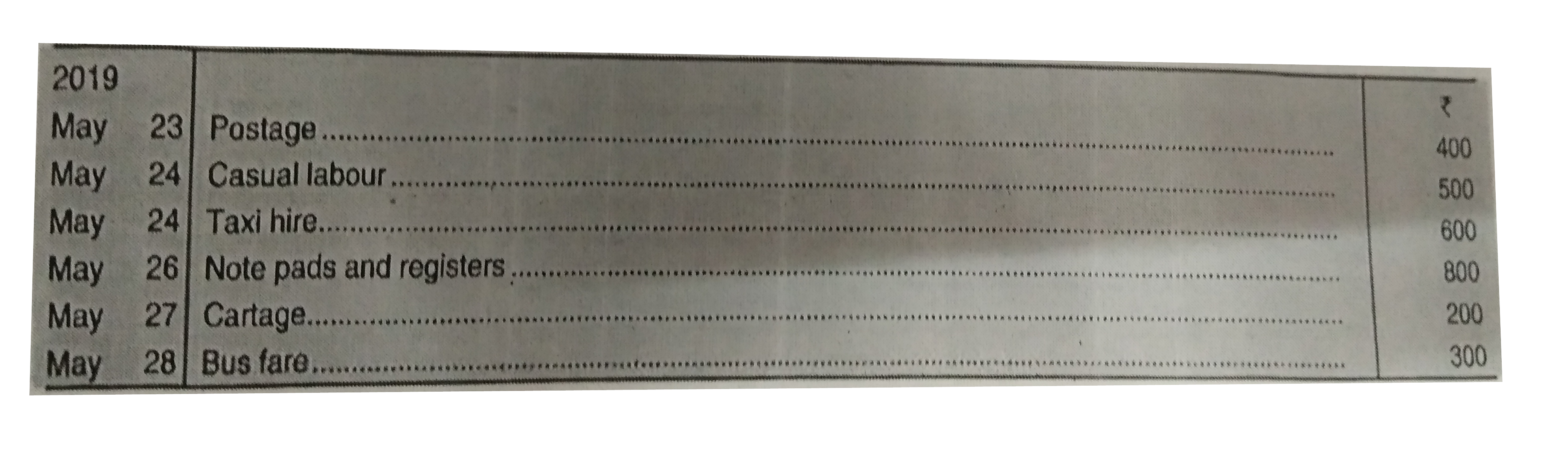

- The following transactions took place during the week ended 28th May, ...

Text Solution

|

- Sri R maintains a Comumnar Petty Cash Book on the lmprest System. The ...

Text Solution

|

- A Petty Cashier in a firm received Rs. 15,000 as the petty cash impres...

Text Solution

|